high low method machine hours

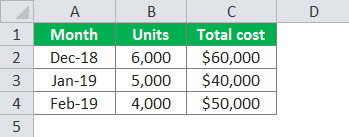

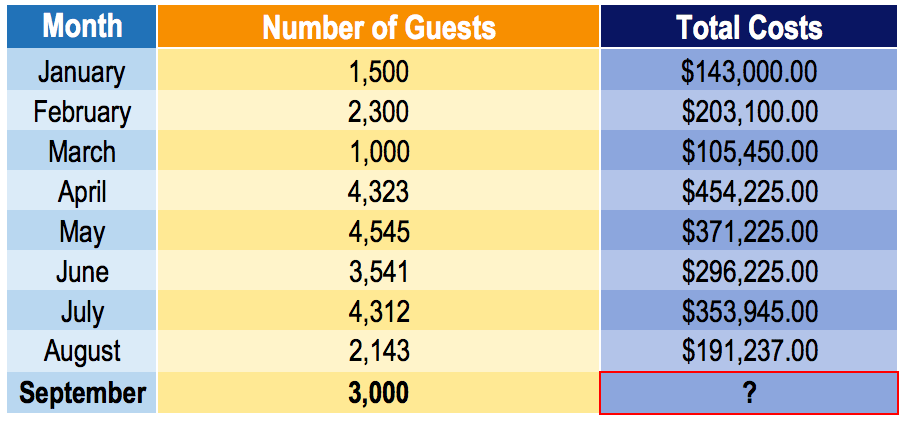

What total overhead cost would you expect to beincurred at an activity level of 46000 machine-hours. Month Maintenance Cost Machine Hours.

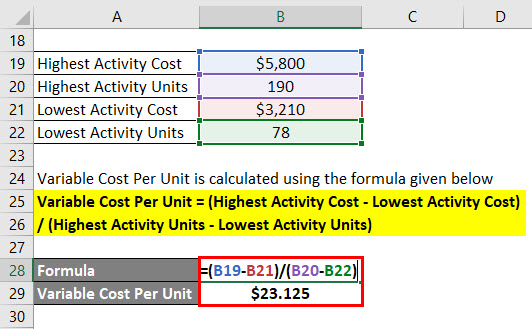

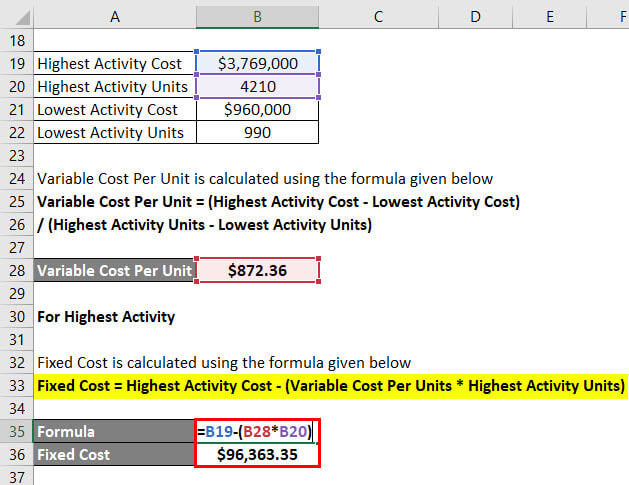

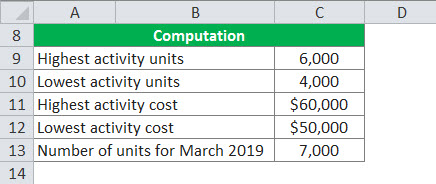

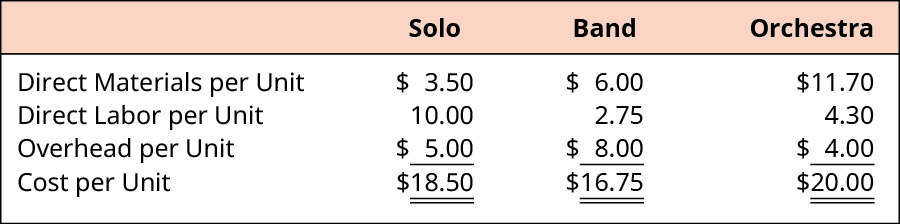

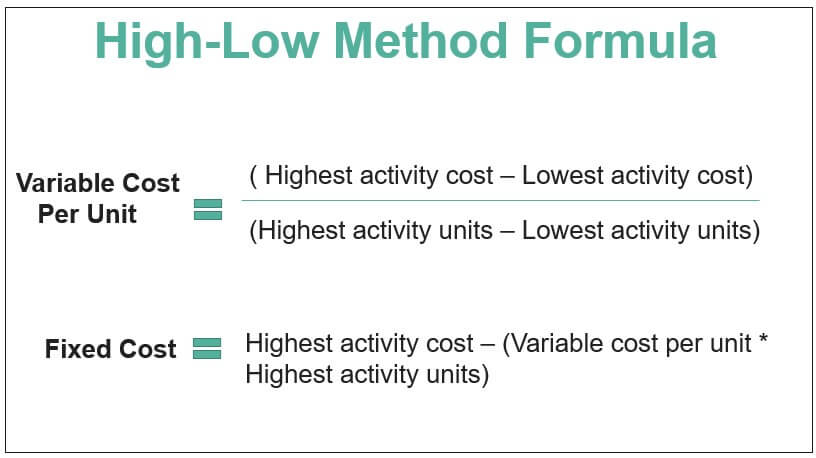

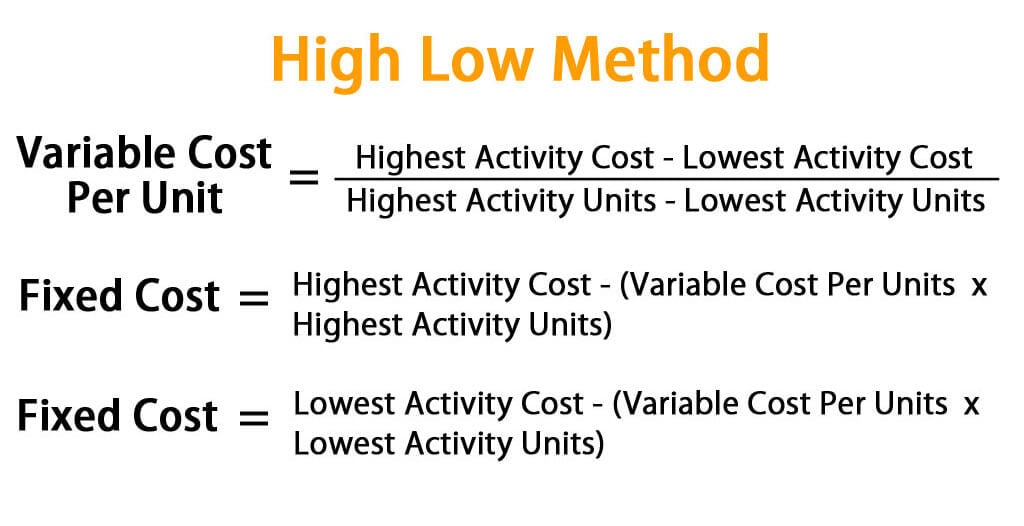

High Low Method Calculate Variable Cost Per Unit And Fixed Cost

13000 machine hours are worked.

. In cost accounting a way of attempting to separate out fixed and variable costs given a limited amount of data. Low High Machine-hours 51300 68400 Total factory overhead costs 222690 pesos 244920 pesos-----The factory overhead costs above consist of indirect materials rent and maintenance. High-low Method is used in Accounting to separate fixed and variable cost element from historical cost that is a mixture of both fixed and variable cost and with the use of the high low formula per unit variable cost is measured by subtracting the cost of lowest activity from the cost of highest activity and dividing the resultant amount from.

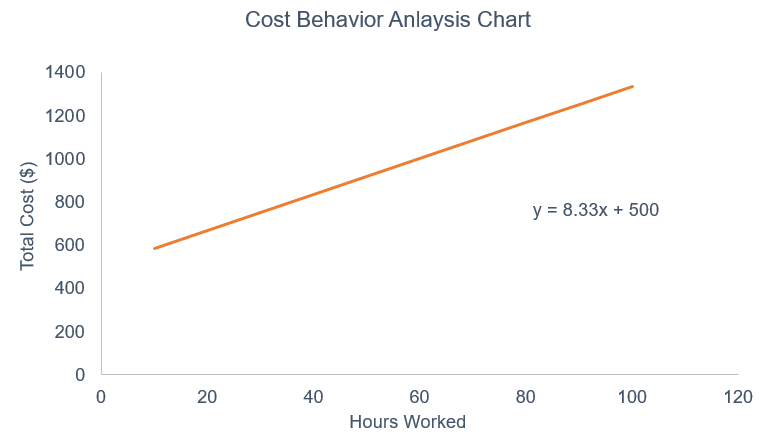

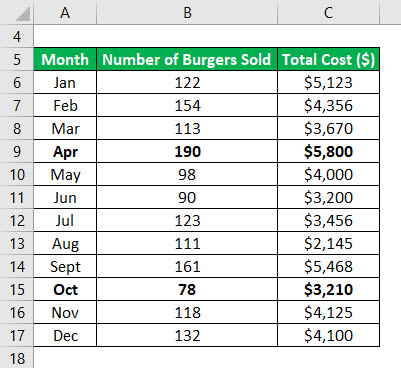

Change in cost Change in volume Variable cost slope 는 - X Data table Round the variable cost to the nearest cent Using the high-low method the variable utilities cost per machine hour is 160 Machine Hours 1050 Requirement 2. Machine Hours Electrical Cost January 4000 3120 February 6000 4460 March 4800 3500 April 5800 5040 May 3600 2900 June 4200 3200 Required. A 25400 B 25560.

Hotlanta Inc which uses the high-low method to analyze cost behavior has determined that machine hours best explain the companys utilities cost. 300 050 X. The high-low method involves taking the highest level of activity.

Using either the high or low activity cost should yield approximately the same fixed cost value. Express the companyâ s total overhead cost in theform Y a bX. Units labor hours machine hours etc and the corresponding total cost figures high-low method only takes two extreme data pairs ie.

The highest and the. The high low method shows the difference between the high and low cost of a particular thing. Given a set of data pairs of activity levels ie.

It is a nominal difference and choosing either fixed cost for our cost model will suffice. Assuming Cosco Company uses the high-low method of analysis if machine hours are budgeted to be 20000 hours then the budgeted total maintenance cost would be expected to be. In the given question the high cost is 3600 and the low cost is 2700 whereas the high machine hour is 18000 and low machine hour is 10000.

Determine the variable cost. Using the high-low method of analysis estimate the variable electrical cost per machine hour. The company has analyzed these costs at the 51300 machine-hours level of activity as follows.

Using the high-low method estimate a cost formula formaintenance in the form Y a bX. High-Low method is one of the several mathematical techniques used in managerial accounting to split a mixed cost into its fixed and variable components. A manufacturing company estimates semi-variable costs by using the high-low method with machine hours as the cost driver.

Period Semi-Variable Costs Machine Hours 1 100000 22000 2 120000 30000 3 96000 23600 If 29000 machine hours were budgeted for the next period estimated semi-variable costs would total A. 3 rows Crane Inc has collected the following information on its cost of electricity. Predict the level of maintenance cost that would be incurred during a month when 45000 machine hours are worked.

Assuming Cosco Company uses the high - low method of analysis if machine hours are budgeted to be 20000 hours then the budgeted total maintenance cost would be expected to be. What is the estimate of the total cost when 300 machine-hours are used. Recent data are shown below.

Variable Cost 750 - 500 900 - 400. Assuming Cosco Company uses the high-low method of analysis the fixed cost of maintenance would be. Monday June 14 1999 94351 AM.

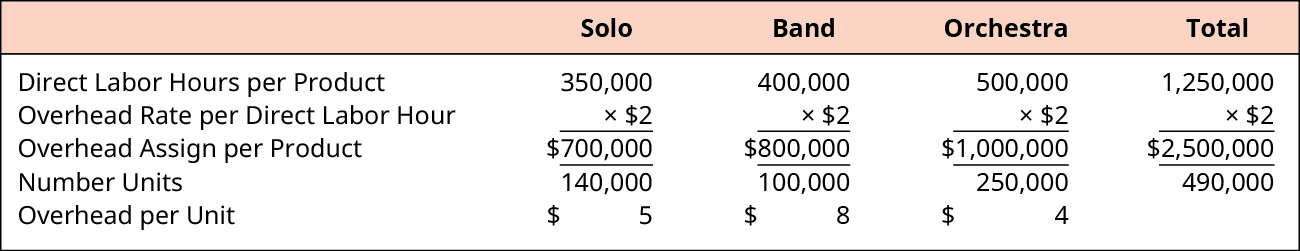

The companys expected annual fixed overhead is 340000 and its variable overhead cost per machine hour is 2. To solve this using the high-low method formula subtract the lower cost from the higher cost to get a numerator of 27675 then subtract the lowest number of units from the highest quantity to. J Jones Created Date.

The information for 20x3 is provided below. The plants theoretical capacity is 850000. Use the high-low method to estimate the variable cost per machine hour and the fixed cost per month.

Your answer is. Activity based costing can provide a more useful analysis of the behavior of cost in relation to distinct activities. The Cost function will be.

The electricity cost which varies in relation to machine hours is 050. High-low method is used to separate the variable and fixed cost element of a mixed cost or semi variable expense. It is shown below.

Now the formula for high low method is calculated. Indirect materials variable 56430 pesos Rent fixed 129000 Maintenance mixed 37260. The companys relevant range is from 200000 to 600000 machine hours.

The companys relevant range of activity varies from a low of 600 machine hours to a high of 1100 machine hours with the following data being available for the first six months of the year. Up to 256 cash back 2. Machine-Hours Maintenance Costs Highest observation of cost driver 140000 280000 Lowest observation of cost driver 95000 190000 Difference 45000 90000 Maintenance costs a b Machine-hours Slope coefficient b 90000 45000 2 per machine-hour Constant a 280000 280000 0 or Constant a 190000.

Assume that the relevant range includes all of the activity levels mentioned in this problem. To illustrate the high-low method lets assume that a company had total costs of electricity of 18000 in the month when its highest activity was 120000 machine hours. Machine-hours Labor Costs Highest observation of cost driver 400 10000 Lowest observation of cost driver 240 6800 2.

The Hunter Company uses the high-low method to estimate the cost function. Lets begin by determining the formula that is used to calculate the variable cost slope. Fixed cost 105450 7497 x 1000 30480.

Walton expects to operate at 425000 machine hours for the coming year. A 25400 B 25560. High Low Method assumes a linear relationship between cost and activity which is an over simplified analysis of cost behavior.

High Low Method is not representative of entire data as it is based on just 2 activity levels. Note that our fixed cost differs by 635 depending on whether we use the high or low activity cost. Be sure to match the dates of the machine hours to the electric meter reading dates.

Circuit Training Exercise Poster Circuit Training Circuit Training Workouts Fitness Training

High Low Method In Accounting Definition Formula

Warsun Z3 Powerful Brightness Usb Rechargeable Outdoor Hunting Led Flashlight Power Bank For Sale Lustreon In 2022 Led Flashlight Flashlight Usb Rechargeable

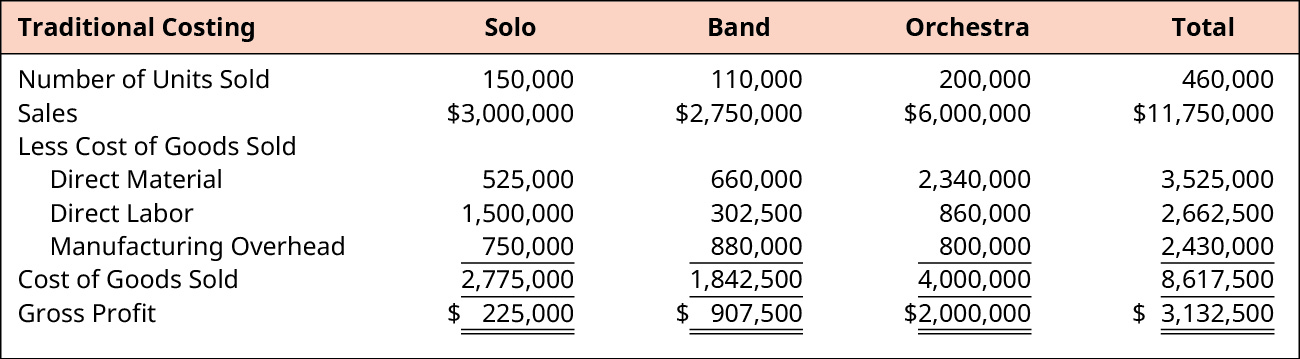

Calculate Predetermined Overhead And Total Cost Under The Traditional Allocation Method Principles Of Accounting Volume 2 Managerial Accounting

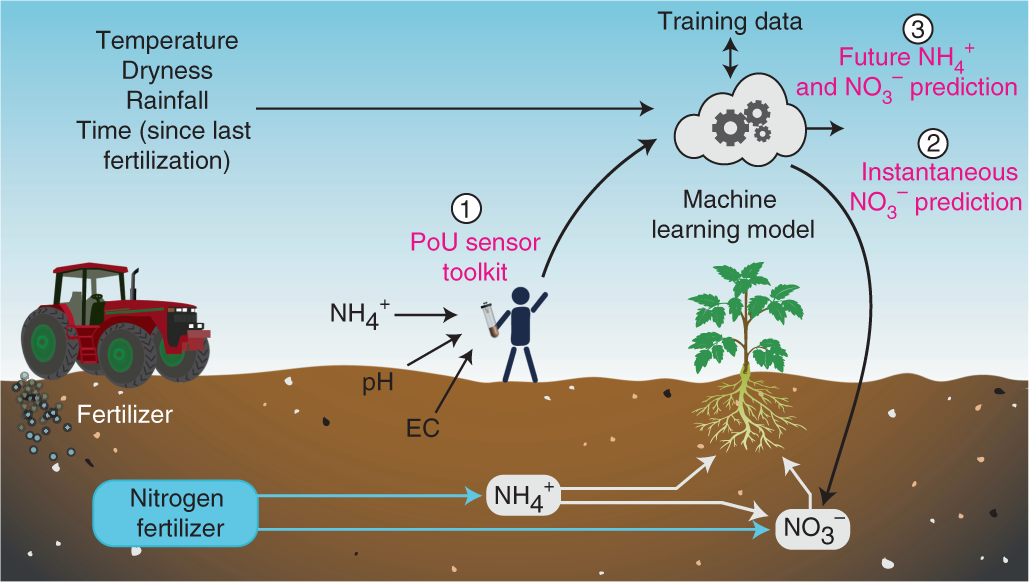

Point Of Use Sensors And Machine Learning Enable Low Cost Determination Of Soil Nitrogen Nature Food

Cost Behavior Analysis Analyzing Costs And Activities Example

High Low Method In Accounting Definition Formula

High Low Method Calculate Variable Cost Per Unit And Fixed Cost

High Low Method Learn How To Create A High Low Cost Model

High Low Method Learn How To Create A High Low Cost Model

High Low Method Calculate Variable Cost Per Unit And Fixed Cost

High Low Method Accounting Meaning Formula Example And More In 2021 Accounting Accounting Principles Accounting Education

High Low Method In Accounting Definition Formula

Calculate Predetermined Overhead And Total Cost Under The Traditional Allocation Method Principles Of Accounting Volume 2 Managerial Accounting

High Low Method In Accounting Definition Formula

What Is The High Low Method Gocardless

High Low Method In Accounting Definition Formula

Calculate Predetermined Overhead And Total Cost Under The Traditional Allocation Method Principles Of Accounting Volume 2 Managerial Accounting

High Low Method Calculate Variable Cost Per Unit And Fixed Cost